Bank Pensioner

The blog deals with the issues regarding the retired bank employees who have opted for pension.

Saturday, March 9, 2024

Thursday, February 1, 2024

Tuesday, August 1, 2023

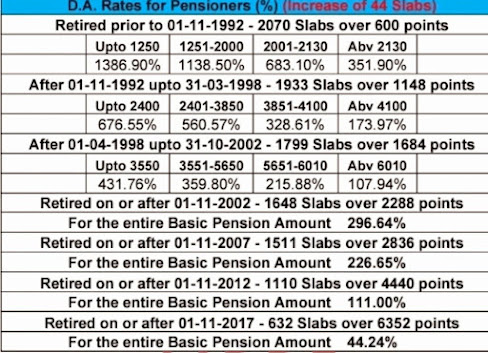

DEARNESS RELIEF PAYABLE TO PENSIONERS W.E.F.1ST AUG'23 TO 31ST JAN'24.

D.A calculator is available for calculating revised D.A. and difference. For calculating D.A , enter basic ( original basic without reducing commutation amount) and click on the calculate button. Revised D.A , Present D.A. and difference will be displayed on the calculator. Select appropriate retirement date range according to the date of retirement.

Click on the following link for D A Calculator.

Saturday, July 29, 2023

100 % DA Neutralisation calculator for pensioners retired beween 01/04/1998 and 31/10/2002

UFBU and IBA signed agreement for extending the benefit of 100% DA neutralisation to pre NOV 2002 retirees on 29th July 2023. There will be no arrears and effective date will be declared after concurrence with DFS.

Click on the link below for 100 % DA Neutralisation calculator for pensioners retired beween 01/04/1998 and 31/10/2002

Calculator is based on DA rate effective for period Feb 23 to Jul23. (No of slabs 1755)

From Aug 23 on wards DA rate will be different

100 % DA Neutralisation calculator

Wednesday, February 1, 2023

DEARNESS RELIEF PAYABLE TO PENSIONERS W..E.F. 1ST FEB 23 TO 31ST JULY 23

D.A calculator is available for calculating revised D.A. and difference. For calculating D.A , enter basic ( original basic without reducing commutation amount) and click on the calculate button. Revised D.A , Present D.A. and difference will be displayed on the calculator. Select appropriate retirement date range according to the date of retirement.

Click on the following link for D A Calculator.